Reporting

Reporting and payment of environmental fees/producer responsibility dues are to be done on a monthly basis and within one month of the end of the following month. For example, for July 1, these applicable sales should be reported on and paid for by August 1.

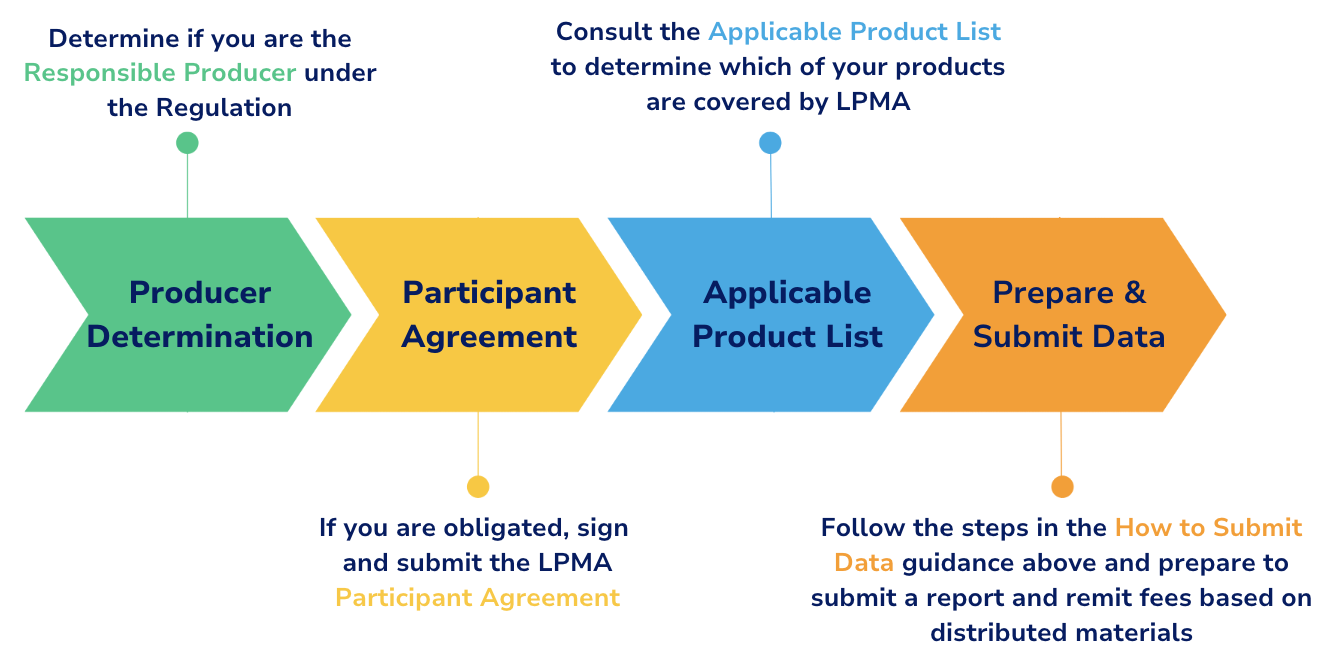

Follow these steps for accurate reporting:

1. Register with LPMA

- Sign the Participation Agreement for each state and submit via email to memberservices@interchange360.com. You will receive

2. Prepare Your Data

- Assign a team or individual to oversee data collection and reporting.

- Identify covered materials and quantities distributed.

- Collect and validate data, such as sales volumes, material types and size of packaging.

3. Reporting and Payment Timelines

- Reports and Payments must be submitted monthly.

- Due Date: Within 30 days after the end of each month.

Notes:

- Nil reports must be submitted even if no products were sold in a reporting period.

- Fee schedules are published on the Interchange 360 website and may change from time to time.

- Compliance Reviews of Producer reports are completed on a risk-based frequency.

EPR Fee/Dues Remittance Forms

Members will use these forms to report sales data by state and calculate their total remittance owing for the reporting period. Sales data reporting and payment is due 30 days after the reporting period ends.

Please email your completed Remittance Form to accounting@interchange360.com.

If you still need payment advice, our Finance Team can provide this to you by emailing the same address.

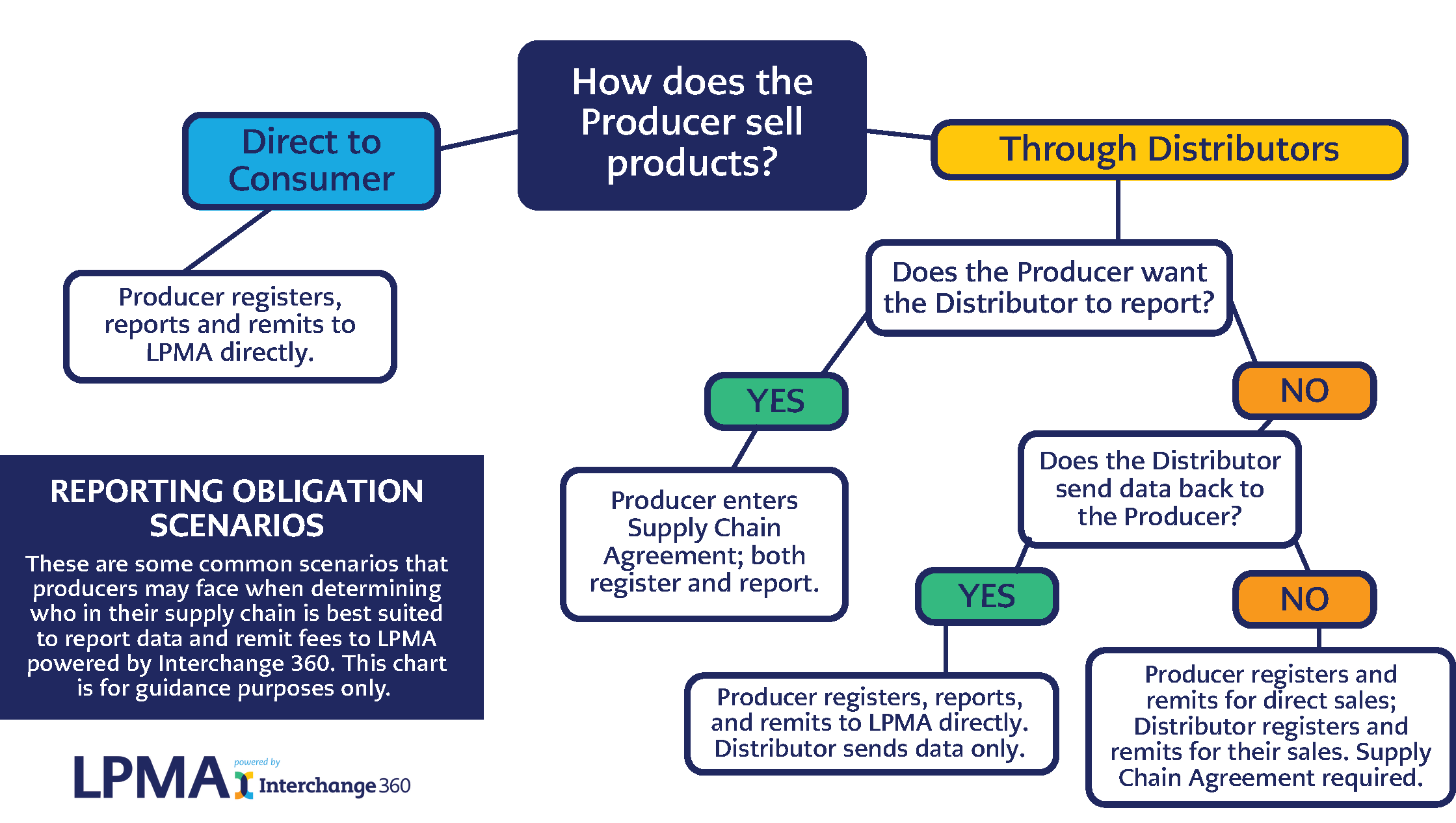

Who is the Obligated Reporting Party?

If you’re unclear about your reporting obligations, we’ve created a flowchart to help determine who in their supply chain is best suited to report data and remit fees to LPMA powered by Interchange 360: