Resource Center

Welcome to the LPMA powered by Interchange 360 Producer Resource Center, your hub for resources on regulatory compliance for Producers of petroleum and automotive products and their associated packaging. On this page, Members can access the Producer Guidance Document, EPR Fee/Dues Remittance Form and other key information related to EPR compliance.

Producer Guidance Document

This industry specific Producer Guidance Document provides essential steps for determining Producer status, supply chain agreement best practices, and data reporting requirements.

EPR Fee/Dues Remittance Forms

Producers will use these forms to report sales data by state and calculate their total remittance owing for the reporting period. Sales data reporting and payment is due 30 days after the reporting period ends.

Please email your completed Remittance Form to accounting@interchange360.com.

If you still need payment advice, our Finance Team can provide this to you by emailing the same address.

Send any questions via email to our Member Services team at memberservices@interchange360.com

Who is the Obligated Reporting Party?

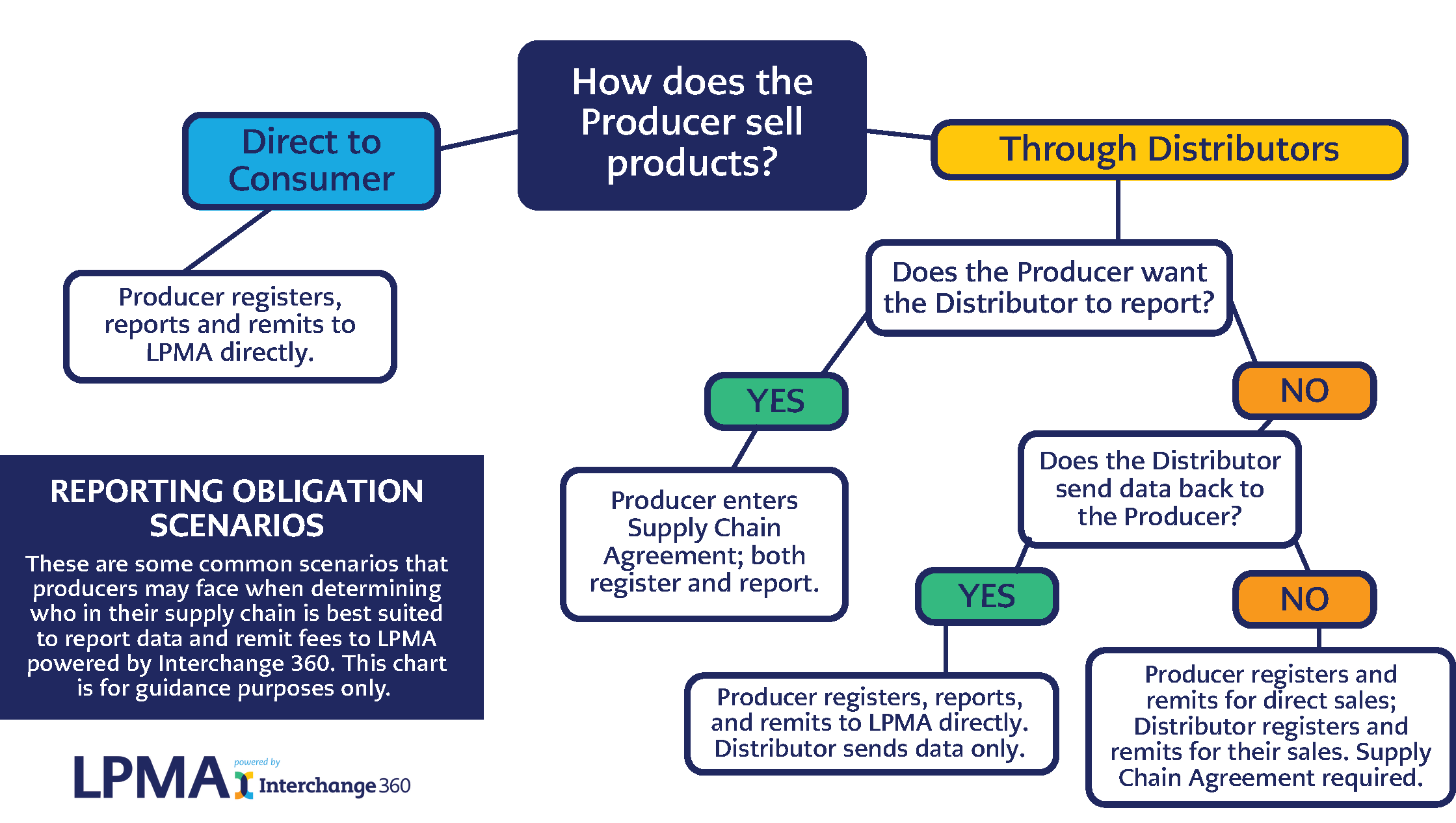

If you’re unclear about your reporting obligations, we’ve created a flowchart to help determine who in their supply chain is best suited to report data and remit fees to LPMA powered by Interchange 360:

How to Register

Producers register with LPMA powered by Interchange 360 by completing and submitting Participation Agreements for each regulated state in which they sell products. A registration confirmation email will be sent within five days of submitting a Participation Agreement.

Post-Registration Compliance

Once the Participation Agreements are signed, covered producers will pay planning and/or implementation fees to Interchange 360 based on the volume of covered material sold in each state. The fees will cover the planning and implementation of each state program. For more information on fees and reporting, visit the Producer Compliance page.

Producer Webinars

We are committed to providing our Members and Participants guidance on Extended Producer Responsibility (EPR) and sharing best practices to ensure fulfill compliance obligations and promote environmental stewardship. As part of that commitment, we will be conducting Producer Webinars and posting the replays for reference and sharing.

Visit the Webinar Replays page to watch past webinars and download copies of the presentation decks.

FAQs

How often and when do we report to LPMA powered by Interchange 360 on applicable product sales into applicable states?

Reporting and payment of environmental fees/producer responsibility dues are to be done on a monthly basis and within one month of the end of the following month. For example, for July 1, these applicable sales should be reported on and paid for by August 1.

We sell directly to customers, but we also sell to distributors. Should we provide data only for what we ship directly, or is it expected that we also estimate what our distributors might send to applicable states?

The goal is to ensure that all of your applicable products sold into applicable states are reported. For sales through distributors, individual state EPR laws would define who is considered a Producer. If your distributors are considered a Producer, are registered with a Producer Responsibility Organization and have an agreement with you that they will report on and pay any applicable environmental fees/producer responsibility dues, then sales to those distributors can be excluded from your reporting to LPMA powered by Interchange 360.

The term “Producer” is mentioned in the LPMA powered by Interchange 360 documents. Are you referring to the “brand owner,” or are you also including private label products, for which we are not the brand owner?

Producer is a term which will be defined in each individual state EPR laws including categorization of Brand Owners. For example, the Colorado EPR law includes a “Producer Determination Flow Chart”. Private label products where the brand owner is a considered a producer, where the brand owner is a member of a PRO and reporting on and paying the applicable fees/dues, should not be included in your reporting. For additional clarity, it is recommended that you have the brand owner confirm to you that they are a member of a PRO and taking responsibility for the applicable fees/dues on the private label products.

Will the United States have product EPR fees like Canadian provinces?

In the United States, the fees will be set by the PROs (like LPMA powered by Interchange 360) to cover whatever the obligations are under each state regulation. As such, there would then be a fee for each product (but in this case set by the PRO as opposed to a provincial organization (like in BC, AB etc.). And each product types and producer determination would be set by each state and we expect that there will be some variances between states